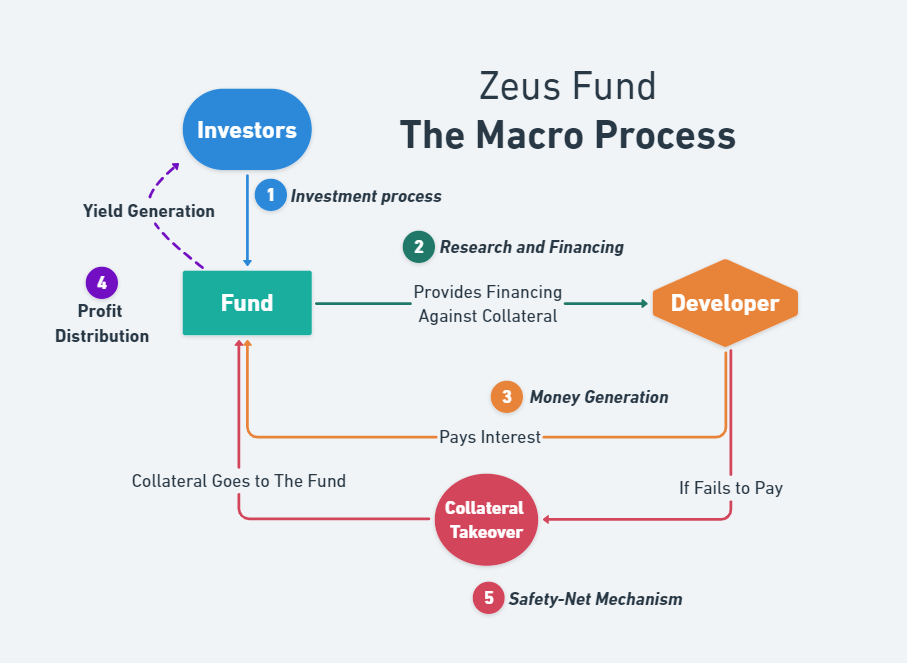

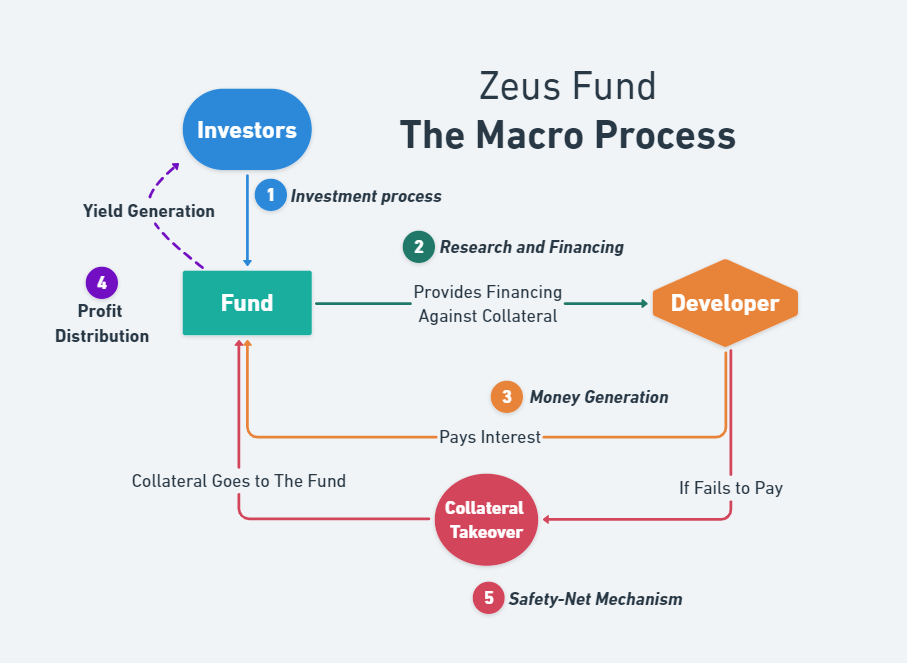

The Macro process: How Zeus Fund works

Like a bank, the fund provides finance and generates interests. In a case of a default, the fund takes over the collateral

The process of investing is as follows:

Escrow

Your money is being safely deposited in an escrow account

5-day Refundable downpayment (deposit)

You start by investing %15 of the amount you expect to invest as a deposit.

Your deposit can be refunded withing 5 days.

In this time – you will be able to access the fund’s financial data and learn more about what could be expected

“Call the money”

At a certain point, once the fund is ready to take on financing a project, you will be asked to deposit the rest of the funds, and we are up and running.

The fund perform a deep research and vetting to find the best projects to finance

Project research

Execution

The developer has to pay interest over time for the financing

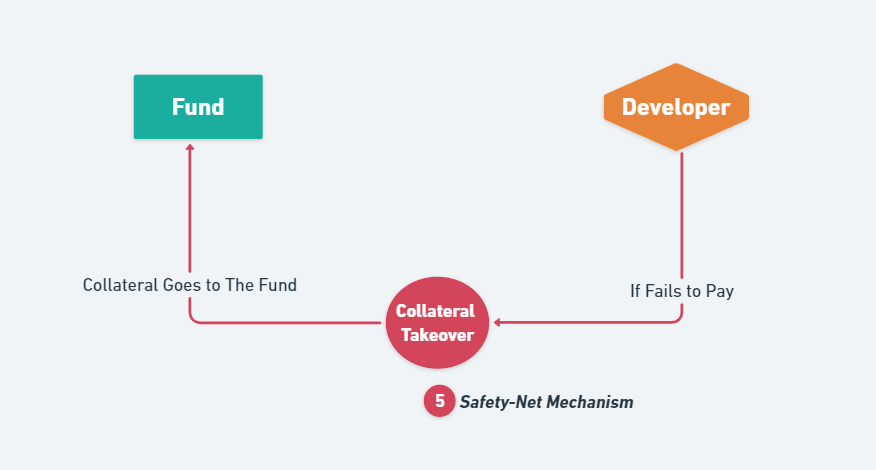

Just like a bank, when the developer fails to pay the interest, the collateral is being taken over by the fund

As an investor, you have 2 options to generate yield from your investment:

Option 1 – Withdraw every 3 months:

Every 3 months, the fund allows its investors to withdraw their profits.

Option 2 – Generate compound interest

If you choose to keep the money inside, you will generate compound interest on the money on the next project.

The Macro process: How Zeus Fund works

Like a bank, the fund provides finance and generates interests. In a case of a default, the fund takes over the collateral

We are turning opportunity into result and putting our investors first. With exceptional ideas and orderly plans to realize our vision and do the right thing for our investors.

Dawn Tower, 25th floor Ariel Sharon 4 Givatayim

077-9725627

052-3444196

Office@zeusgrp.com

© 2021| All rights reserved to Zeus Group